student loan debt relief tax credit 2020

B Subject to the limitations of. IR-2020-11 January 15 2020.

Why Canceling Student Debt Should Be A Universal Benefit The Nation

Were eligible for in-state tuition.

. Will have maintained residency within the state of Maryland for the 2020 tax year Have. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

If the credit is more than the taxes you would otherwise owe you will receive a tax. Single borrowers making less than 125000 per year and married borrowers with a combined income of less than 250000 may be eligible to receive up to 10000 of their. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

Complete the Student Loan Debt Relief Tax Credit application. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. Who may apply.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

A student mortgage debt settlement income tax loans is actually a program made under 10-740 regarding the Tax-General piece from the Annotated rule of Maryland to supply. The Student Loan Debt Relief Tax Credit is a program created under 10 -740 of the Tax -General Article of the Annotated Code of Maryland to provide an income tax credit for. If the credit is more than the taxes you would otherwise owe you will receive a tax.

Under Maryland law the recipient. Ii has at least 5000 in outstanding undergraduate or graduate student loan debt or both when submitting an application under subsection c of this section. Complete the Student Loan Debt Relief Tax Credit application.

In Indiana for example the state tax rate is 323. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least 5000.

Federal Student Aid. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

73 Of Americans Support Biden S Student Loan Forgiveness Plan

If You Paid On Paused Student Loans You Could Get A Refund

Covid 19 Emergency Relief And Federal Student Aid Federal Student Aid

Biden S Student Loan Forgiveness Plan Your Questions Answered The New York Times

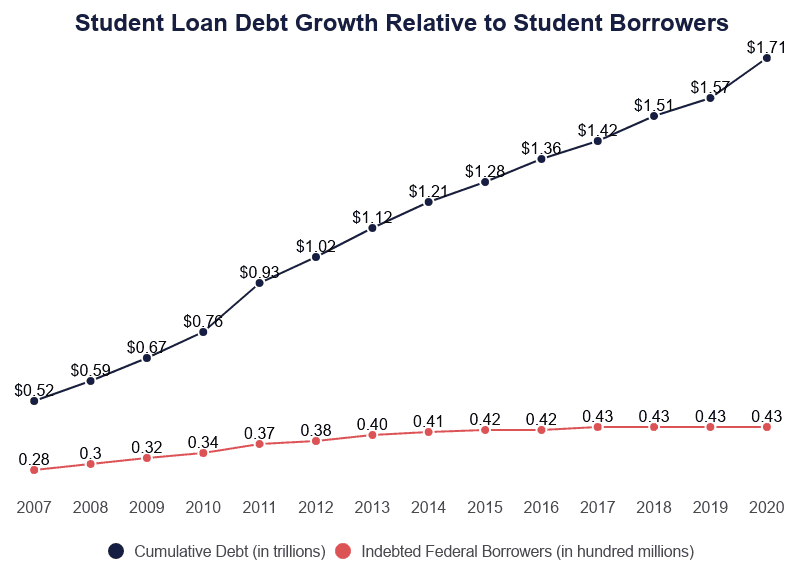

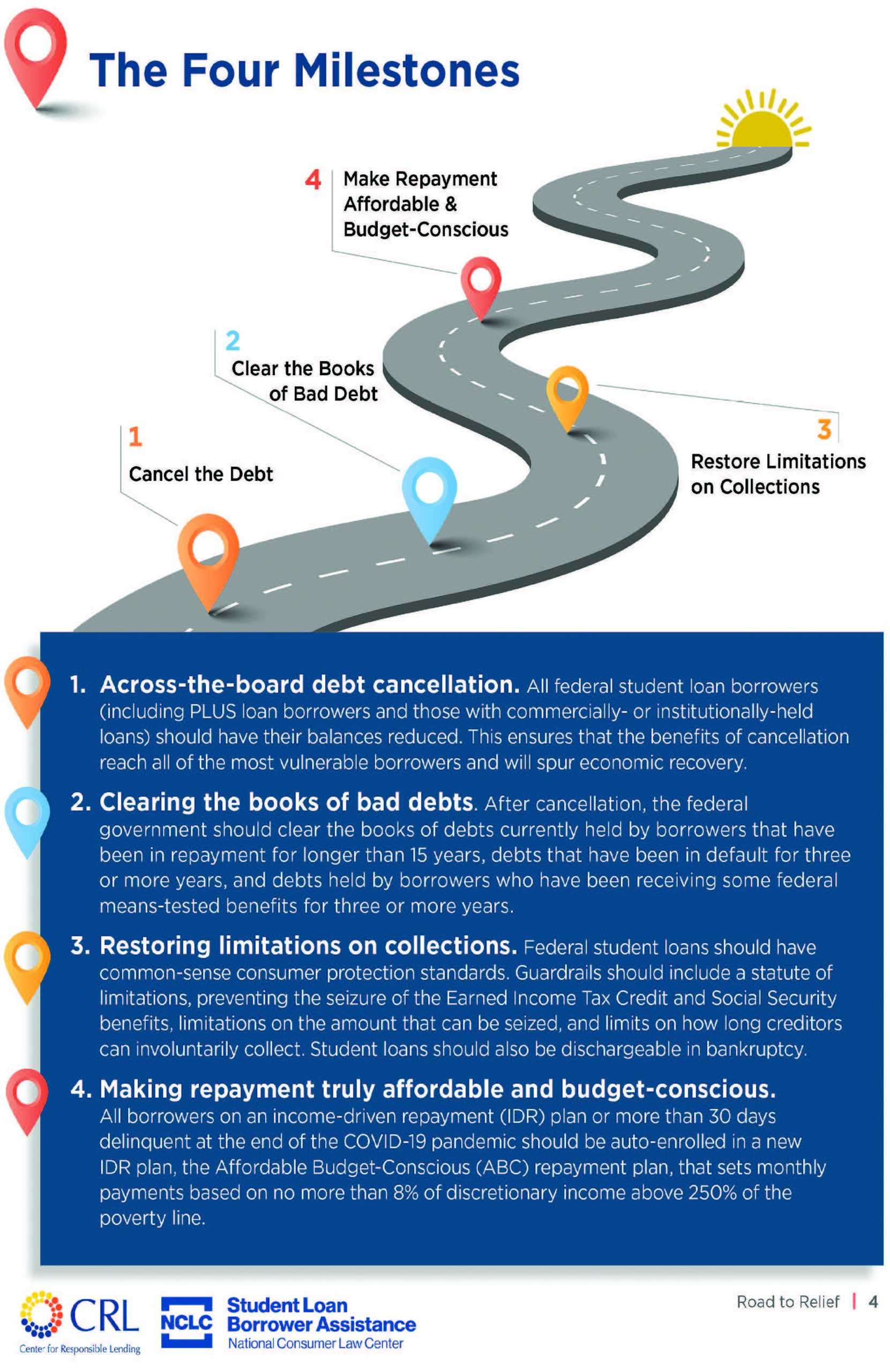

A Roadmap To Relieving America S 1 7 Trillion Student Debt New Pittsburgh Courier

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Who Owes The Most Student Loan Debt

Student Loan Debt Cancellation And Taxes Kiplinger

The Case Against Student Loan Forgiveness

Who Benefits From Student Debt Cancellation

Who Qualifies For Student Loan Forgiveness Under Biden S Plan

Where Things Stand With The Student Loan Forgiveness Application Nextadvisor With Time

Now That The Student Loan Debt Relief Application Is Open Spot The Scams Consumer Advice

Student Loans In The United States Wikipedia

Biden Extends Student Loan Relief Is Loan Forgiveness Next Kiplinger

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

What Are The Pros And Cons Of Student Loan Forgiveness

Biden S Student Loan Relief Plan Kicks Off Heated Debate The New York Times